The IRS Has Guides for Business-Related Tax Changes

Monday, January 28 marked the start of filing season for 2019, which means millions of tax-year 2018 individual and business returns will start being sent to the Internal Revenue Service. While taxpayers may have at least heard about the new tax brackets and lowered corporate tax rate, it’s probably safe to say they don’t have a full understanding of all the changes included in the Tax Cuts and Jobs Act (TCJA). That’s why the IRS recently highlighted a number of resources explaining how the new tax law affects businesses.

Tuesday’s IRS Newswire lists five webpages the agency has created to help navigate the various tax law changes directed at businesses: ” Tax Reform Provisions that Affect Businesses;” “Tax Reform for Small Business Initiative;” “Tax Reform Resources;” “Tax Cuts and Jobs Act: A Comparison for Businesses and “Publication 5318, Tax Reform: What’s New for Your Business.” The first four pages are basically hubs dedicated to specific aspects of the business-related tax law changes, while the final link—in the IRS’ own words—“covers many of the TCJA provisions that are important for small and medium-sized businesses, their owners, and tax professionals to understand.”

The first three pages (“Tax Reform Provisions that Affect Businesses,” “Tax Reform for Small Business Initiative,” and “Tax Reform Resources”) use accordion menus—essentially a series of buttons that are drop lists—to help users avoid information overload. For example, after navigating to the “Tax Reform Provisions that Affect Businesses” page, you see a series of grey bars bearing names like “Participation Exemption System for Taxation of Foreign Income” beneath a subheading titled “Income (including Gains and Losses).” When you click on one of those bars, a drop list unfurls that contains a short description of the topic and links to relevant IRS press releases and publications.

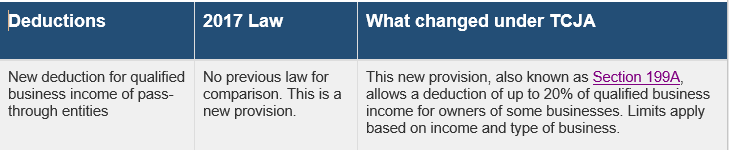

“Tax Cuts and Jobs Act: A Comparison for Business” contains tables for deductions, depreciation, and expensing; fringe benefits and new credits; tax-favored investments; and more. Each table has a column for an example of the topic, what tax law said prior to tax reform, and how TCJA changed the relevant tax law. Here’s an example from the Deductions table:

Explanations for the changes from TCJA often include links to notices, forms, and publications, helping direct the reader to build an even better understanding of how tax reform affects a given tax situation.

Finally, the IRS notes that Publication 5318 addresses several important changes that are relevant to tax professionals and tax payers alike: the new Section 199A qualified business income deduction, changes to Section 168 and 179 deductions, and adjustments to C and S corporations. This resource provides a broad overview of a lot of important topics, and it should be at the top of any tax professional’s reading list this filing season.

Source: IRS Newswire