Felecia Dixson is a nationally recognized tax expert, seasoned practitioner, and software trainer with decades of experience in compliance, tax preparation, and workflow optimization. Operating a solo practice in Missouri, she serves over 100 clients, many of whom present high-value compliance and IRS representation cases. To manage the demands of her growing practice, Felecia turned to GruntWorx as a strategic solution for improving efficiency, accuracy, and document intake. By automating manual processes, she has been able to stay focused on high-value work while maintaining control over her operations.

GruntWorx Case Studies

Select a case study to show its sections. Select a section to show its content.

Case Study 1: GruntWorx in a Solo Compliance Practice

As a solo practitioner managing a compliance-heavy workload, Felecia Dixson faced a range of operational and strategic challenges in her tax representation practice. The high volume of clients required meticulous attention to detail and efficient processing, yet she had limited time and capacity to train staff or delegate manual data entry tasks. Her clients frequently submitted large and complex data sets—often late in the process—which added pressure to an already demanding schedule. The intricacies of tax resolution demanded her full focus, leaving little room for administrative overhead. At the same time, she sought a way to simplify document intake without compromising control over her workflow, aiming to maintain both accuracy and efficiency while expanding her capacity for IRS representation, tax planning, and business development. Balancing these responsibilities under tight deadlines created a need for streamlined solutions that could support both quality and growth.

Felecia Dixson leverages GruntWorx to streamline the intake and processing of tax documents, allowing her to focus on high-value work such as IRS representation, compliance, and financial documentation. She uses Liscio and Dropbox to collect client files, which she then uploads directly into GruntWorx, creating a seamless and efficient workflow. One of the key advantages she values is the ability to manage large and complex tax files—such as those with over $1.4 million in 1099-B transactions—with ease. By delegating repetitive data entry to GruntWorx, she significantly reduces her manual workload and improves turnaround time. The platform integrates smoothly with her existing systems, and she is particularly enthusiastic about the upcoming GruntWorx integration button in Liscio, which she describes as “highly beneficial, especially with the static pricing.” Felecia processes one client at a time to maintain organization and appreciates features such as uploading multiple files without overwriting prior data, identifying password-protected documents that require manual handling, and resubmitting late-arriving brokerage statements without disrupting the workflow. As she explains, “Sometimes a client shows up with a brokerage statement after I’ve already submitted the return. I love that I can just throw it back in and GruntWorx adds it right in. That’s significant.” Her adoption of GruntWorx’s Return-Based Pricing model has further simplified her process by eliminating the need to separate documents for pricing, enhancing both speed and operational convenience.

- Saves hours per return by avoiding manual entry

- Focuses her expertise on audits, 433s, and IRS work

- Reduces reliance on untrained staff or short-term help

- Feels confident knowing GruntWorx “consistently delivers reliable results”

- Saves 65% of her data entry time

- Avoids burnout by eliminating repetitive entry

- Enables her to focus on IRS work, tax resolution, and book writing

- Confidence that her process works without needing a large team

– Felecia Dixson, EA, CTRC, ATA

Case Study 2: Elevating Efficiency and Work-Life Balance with GruntWorx

Tracy Cook, CPA, is the owner of a well-established accounting firm that specializes equally in individual tax returns and trust and estate (1041) filings. With over nine years of experience running her own practice and a background working at various firms, Tracy brings a wealth of expertise to her client engagements. Her firm utilizes Intuit Lacerte as its primary tax software and has adopted GruntWorx’s GruntWorx PREMIUM suite of tools—including ORGANIZE, POPULATE, and Trade SUMMARY—to enhance efficiency, accuracy, and workflow consistency across her operations.

Before implementing GruntWorx, Tracy Cook’s firm faced several operational challenges that are common among small to mid-sized tax practices. Her team endured long hours and seasonal burnout, largely due to the manual and time-intensive nature of document processing. The lack of standardization in how documents were handled and workpapers were organized further compounded inefficiencies, and much of the workload fell on high-billing staff, increasing costs. Tracy recalled, “I was working 60+ hour weeks, and my CPA had never worked a tax season without constant overtime.” To address these issues, her firm integrated GruntWorx ORGANIZE and POPULATE into their workflow. This allowed them to standardize client documents into clean, bookmarked PDFs, delegate data entry to lower-cost administrative staff, and shift the CPA’s focus to reviewing rather than inputting data. Tracy described the bookmarked PDFs as “a game-changer,” noting how they brought consistency and clarity to their workpapers.

Tracy Cook’s firm has developed a set of workflow best practices that enhance efficiency and maintain consistency across client engagements. The process begins with the CPA pre-screening and selecting only the necessary documents to be placed into a designated “GruntWorx” folder. Unless documents are duplicates or irrelevant, all materials are included to ensure completeness. Supplemental documents that are not compatible with POPULATE are still submitted and organized using internal lead sheets. Administrative staff play a key role by formatting Excel outputs to the firm’s standards before importing the data into Lacerte. For trust and estate returns (1041s), the firm plans to use GruntWorx ORGANIZE for the 2026 tax season and is exploring the use of Schedule D Excel outputs for future imports. As Tracy notes, “Anything I can offload to lower-cost admin time is a win,” underscoring the importance of leveraging staff effectively to streamline operations.

- 1.5 hours saved per return (1 hour for CPA, 30 minutes for the owner)

- Overtime nearly eliminated

- Consistency across all workpapers

- Reduced errors and fatigue

– Tracy Cook, CPA

Case Study 3: Streamlining Tax Season with GruntWorx

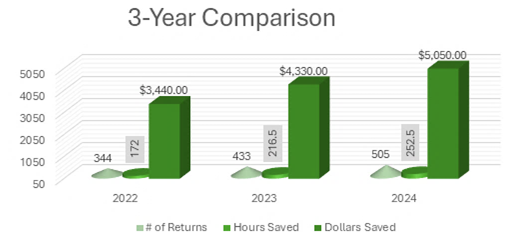

Dawkins & Murray CPA PA is a full-service accounting firm in Wake Forest, NC, offering tax, accounting, and forensic services to individuals and small businesses. Partner Jean Murray shared how integrating GruntWorx into their workflow has led to measurable time savings and improved accuracy. With quicker turnaround times and ease of use, over the last 7 years, GruntWorx has become a key tool in their tax season success.

Before implementing GruntWorx, the firm struggled with time-consuming manual data entry, especially during peak tax season. It was difficult to keep up with volume, and slow turnaround times for return processing created a bottleneck. They began looking for a solution that could streamline the process, reduce errors, and free up time for more strategic work.

– Jean M Murray, CPA, CRFAC, RFI

Dawkins & Murray CPA PA adopted GruntWorx’s ORGANIZE and POPULATE services to automate document sorting and tax form data entry. Onboarding was gradual, starting with a few returns before fully integrating the tools across their workflow. Jean Murray noted that the improvements in turnaround time and the software’s ease of use made a significant difference. GruntWorx’s enhanced validation tools and continuous product updates stood out to the firm.

Using GruntWorx, the firm has seen major improvements in efficiency and reliability. What used to take up to a week can now be completed in a matter of hours—often within the same day.

– Jean M Murray, CPA, CRFAC, RFI

GruntWorx also helped reduce the cognitive load for staff by minimizing manual data entry, which is especially critical during tax season. It allowed the team to focus on client communication and review, rather than document handling.

Jean estimates she saves 30 minutes per return using GruntWorx. Her best time-saving tip is using GruntWorx for stock sales.

Return to Top

Additional Case Studies to Read & Download (PDF)

Here is a dynamic list of case studies showing you how GruntWorx can transform your practice!

Check back often for more case studies!

GruntWorx Video Testimonials

Watch these short “Spotlight” videos about the experiences others have had using GruntWorx.

GruntWorx Resources

Learning Hub

User guides, quick start guides, and step-by-step videos to get you up and running with GruntWorx.

Learn More!Frequently Asked Questions

Find out everything you need to know to maximize the benefits of GruntWorx.

Learn More!Case Studies & Testimonials

Discover how GruntWorx has significantly enhanced the efficiency and accuracy of tax preparation.

Learn More!Trade Show Schedule

Connect with our team, see live demos, and explore how GruntWorx can streamline your workflow.

Learn More!Job Status

Current average turnaround times are for jobs submitted during business hours.

Learn More!Everything you need to move faster with confidence.

Built for busy tax seasons when quality, speed and flexibility matter most.